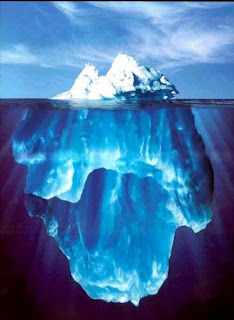

Interesting article in the NY Times, which is primarily the posting of an email from an excutive in the banking industry, stating that the mortgage crisis is only the tip of the iceberg. That what the really big problem will be this coming spring is people defaulting on their credit card debt.

Interesting article in the NY Times, which is primarily the posting of an email from an excutive in the banking industry, stating that the mortgage crisis is only the tip of the iceberg. That what the really big problem will be this coming spring is people defaulting on their credit card debt.I can see how this will be a tremendous problem and no one side is really to blame in all of this. Yes, the banks and other companies should not be sending out credit card applications left and right, but if they didn't then I would have much leftover to open after Mrs. B sorts the mail. Seriously, the people receiving all of the offers for credit cards don't have to get the cards.

Consumers using credit cards need to use credit wisely. Don't run up large balances that can't be paid off by the next payment due date. Or have a plan in place on how long it will take to repay the balance off if it is absolutely necessary to buy whatever it is that is needed.

In the comments posted at the end of the article was one that I thought was pretty good:

"Just because someone gives you a gun, doesn’t mean you aren’t responsible when you shoot somebody–even if that someone is yourself." K.

Just because we receive these offers in the mail, it doesn't mean that we have to accept the cards or use them. We can't put all of the blame on the banks and other companies encouraging us to use these cards, we have to take some responsibility as well. After all, we only have ourselves to blame if we don't use credit wisely.

Let's hope that this iceberg doesn't come to pass this next spring as this banking executive is predicting. I for one, have seen our investments decline in value way too much already.

If the president elect does get an economic stimulus package that will include checks to all taxpayers, let's hope that they include a requirement that all credit card debt has to be paid off before the money can be used for anything else. Not sure how they would accomplish this, but in my opinion, it would certainly go along way toward getting us out of this crisis better than anything else that's been suggested so far.

4 comments:

This whole thing is such a sticky wicket.

Credit card debt! Gah! If I have my ex husband to thank for one thing, it was getting me to wrap my mind around how much money a person loses if one does not pay off their credit card bill each month.

Anymore, I try very hard to use one credit card for everything (even though I have a few others). Then, although the bill is huge, we pay it off each month (it's huge because when I say everything, that is what I mean: gas, groceries, on-line shopping, vet bills, dry cleaning, etc., etc.) This way, OUR money sits in the bank earning some interest until I need to use it to pay off the bill.

When I was younger (pre John) I sort of fell into the trap of having way too many credit cards (and using them way too much and not paying them off).

Now, like I said, it's the one or two (and of course they provide either rebates or airline miles or SOMETHING).

It is amazing how many offers and come ons we continually receive; both in the mail, over the phone, email, and in the stores themselves.

And, you are right, it is up to us, the consumers and users of credit to do so wisely and within our means. Somehow, most of us learned that along the road. Obviously, many other people have not yet learned it. They will.

I wonder how much of this is the outcome of folks that really never had much disposable income (to buy things like new cars or furniture or WIIs or huge flat screened TVs or vacations to exotic locals) and did not, pre all of this mess, have good enough credit to do so on credit.

Then, they get these come ons, and, wow, how seductive would that be?

I'm afraid it is gonna come crashing down around some people's ears; now that their houses are foreclosed on, here will come the repo man for their cars, furniture, TVs, etc.

And their pets will go to shelters because they won't be able to feed them.

No wonder I'm not in the Holida spirit this year!

TA

I have never wanted a to be in lot of debt. Matter of fact, if we didn't get a deduction for mortgage interest for tax purposes, I would be paying that outstanding balance down as quick as possible.

I also read about the commercial real estate market imploding in 2009. Companies like the one that owns Southpoint mall can't make their balloon payment next year, so they preemptively filed for bankruptcy.

You'd think the rent from occupants would generate the needed revenue, but I bet the company was too highly leveraged in other ventures that went kaput so they don't have the cash.

I doubt Southpoint will be empty next by Xmas 2009. However, the new owner might get it for 50 cents on the dollar.

Yes, I've heard some of those rumblings about commerical real estate as well.

I worked for a mall management company for a period of time and, at that time, the leases were typically based on a formula that was determined using projected gross income of the tenant, with some adjustments, and an additional overage charge (this usually was an additional percentage, 2 - 4% dedpending on the tenant, of the amount of sales revenue that exceeded the base gross income amount.) With sales down, I bet the landlords are not receiving enough in the way of overage to service the debt.

Post a Comment